As a small or medium-sized business owner, your competition is always out to get you. Huge companies with behemoth marketing budgets promote themselves everywhere. How can you compete? How can you still get valuable leads, even with a fraction of their marketing budget?

The good news is that YOU CAN. With wise investment (especially in local SEO and engaging social media), you can leverage your geographic position and still get sales.

Let’s see today how you can create such a marketing budget.

Table of Contents

Identify Business Revenue

Your revenue determines how much you can reasonably spend on marketing. Begin by reviewing your gross income over a specific period, such as a month or a year. Accurate revenue data ensures you base your budget on actual financial capacity.

Small businesses typically allocate 5–10% of their revenue to marketing, but this percentage may vary based on growth goals and industry standards. For instance, startups might allocate more to establish a market presence quickly.

Determine a Percentage for Marketing

Deciding how much to spend is important. A general guideline is:

- 5% of revenue: To maintain your current market position.

- 10% or more: For aggressive growth or reaching new audiences.

Consider your business lifecycle. Established businesses often invest less than new ventures needing to build brand awareness.

SMART TIP: you can deduct your marketing expenses, so invest before the end of your tax-year.

Set Marketing Objectives

Budgeting without clear goals leads to inefficiencies. Even if you can “burn” through some money, identify what you aim to achieve with your marketing efforts:

- Increase sales: Invest in lead generation and paid advertising.

- Brand awareness: Allocate more for social media and content creation.

- Customer retention: Focus on email marketing or loyalty programs.

Align each dollar spent with measurable outcomes to ensure every part of your budget contributes directly to your goals.

List Marketing Channels

Outline the platforms and methods you plan to use. For example:

- Digital advertising: Pay-per-click (PPC) campaigns, Google Ads, SEO.

- Social media: Organic posts and sponsored content on platforms like Facebook, Instagram, or LinkedIn.

- Email marketing: Automation tools or freelance services for copywriting.

- Traditional media: Print ads, direct mail, or event sponsorships.

Estimate costs for each channel based on past data or industry benchmarks. Diversifying your channels reduces risk and maximizes reach.

As an SMB owner, if you don’t have too much money to spend, social media, SEO and PPC are your most affordable marketing channels to use.

Separate Fixed and Variable Costs

Fixed costs remain consistent, while variable costs change based on campaigns. Examples include:

- Fixed costs: Subscriptions for marketing tools, website hosting fees, or annual trade show booths.

- Variable costs: Seasonal promotions, influencer partnerships, or additional ad spend during high-demand periods.

Understanding these distinctions helps you manage cash flow while adapting to changing priorities.

Research and Estimate Costs

Gather pricing information for tools, services, and campaigns. For example:

- Google Ads require bidding on keywords, and costs can range widely based on competition.

- Social media ads charge per click or impression, with your daily budgets.

- Freelancers or agencies often charge hourly or project-based fees. Our national SEO services for instance have a fixed rate and it’s easy for you to budget for it.

Overestimate slightly to account for unforeseen expenses, ensuring no part of your campaign falls short due to underfunding.

Track Results and Refine Spending

Effective budgeting doesn’t stop once funds are allocated. Continuously monitor performance using tools like Google Analytics, social media insights, or email campaign dashboards. Analyze:

- Which channels drive the most traffic or conversions?

- Are specific campaigns underperforming despite high costs?

Adjust allocations to focus on strategies delivering the best return on investment (ROI). For instance, if social media ads outperform email campaigns, consider reallocating funds accordingly.

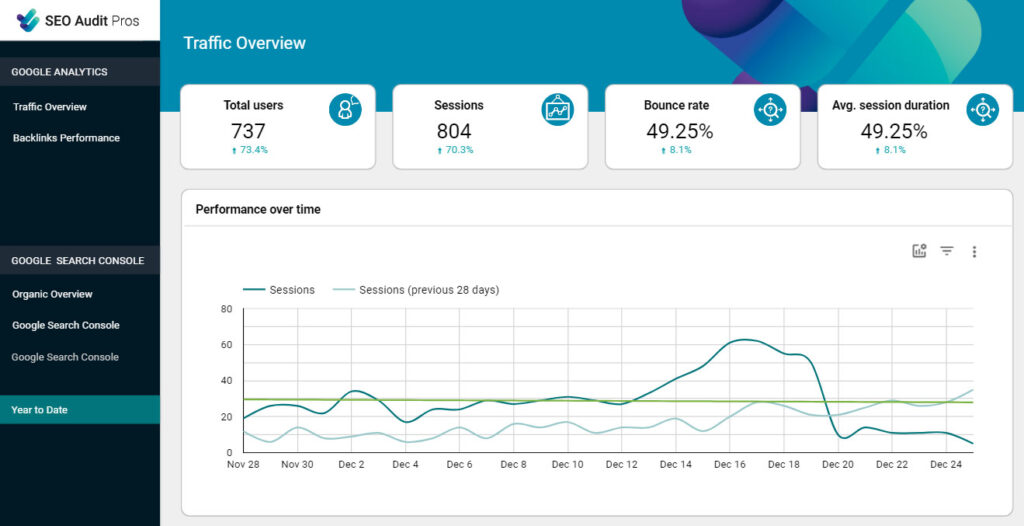

Because I know how grueling reading traffic and rankings data can be, I created a Looker Studio SEO Dashboard that shows you instantly all the information you need. It’s free to access.

Include a Contingency Fund

Markets and trends evolve rapidly, and opportunities or challenges can arise unexpectedly. Reserve 5–15% of your budget as a contingency fund. Use this for:

- Testing new channels or strategies.

- Responding to competitors’ campaigns.

- Managing emergencies, such as a failed campaign needing a quick replacement.

Plan for Seasonal Variations

Business cycles often affect marketing needs. For instance:

- Retail businesses may spend more on ads before holidays.

- Service providers might focus on promotions during slower months to drive demand.

Ensure your budget accounts for these fluctuations, so you can ramp up or scale back spending as needed.

Review and Adjust Annually

A marketing budget should not remain static. At the end of each fiscal year, evaluate the effectiveness of your spending:

- Which investments drove the most revenue or engagement?

- Did you overspend or underspend in any areas?

Use this analysis to refine your strategy for the following year, ensuring continuous improvement in results and efficiency.

Taking these detailed steps makes your marketing budget a strategic tool, not just a financial document. Thoughtful planning, ongoing evaluation, and flexibility ensure your spending drives measurable growth while adapting to changing business needs.

Have any extra insights? Please share them in the comments below: